Gambling winnings and losses are determined on a session basis rather than a per-bet basis. The IRS defines a session of play as beginning when a patron places the first wager on a particular type of game and ending when the same patron completes the last wager on the same type of game before the end of the same calendar day. Gambling winnings are taxed by both the IRS (Internal Revenue Service) and by many states in US All winnings from all forms of gambling are taxable and must be declared as income on your tax return. All losses from all forms of gambling are deductible as an itemized deduction for recreational players, limited to the amount of winnings declared. Enter gambling sessions. The IRS in 2008, and later clarified in 2015, created rules for deducting gambling losses called gambling sessions. The idea was a gambling win wasn't really a true win until the session was completed. A single session is defined as the time between a gambler placing a wager on a certain game and completing the last wager on the game before the end of the same calendar day. The IRS also agreed to.

Gambling remains an ever-popular U.S. pastime. But it's more than just fun and games — gambling can also have serious tax implications. Here are the most important issues involving the federal tax treatment of an amateur gambler's winnings, losses and gambling-related expenses, along with information on a recent favorable development from the IRS.

IRS Proposes New Rules for Electronically Tracked Slot Machines

In March, the IRS released Notice 2015-21, which proposes an optional safe-harbor method for slot machine players to determine wagering gains and losses for federal income tax purposes.

The proposed rules, which are summarized below, indicate that the IRS won't challenge a taxpayer's use of the per-session method to calculate wagering gains and losses from electronically tracked slot machine play if the taxpayer meets these requirements:

Uses Electronically Tracked Play System. This is controlled by the gaming establishment (such as through the use of a player's card or similar system) and records the amount a player wagers and wins on slot machine play.

Uses the Same Session of Play Definition. This is defined as a period that begins when the player places the first wager of the calendar day on a particular type of game and ends when the player completes the last wager on the same type of game before the end of the same calendar day. A session always refers to a specific 24-hour period that starts at midnight and ends no later than 11:59 PM. The same session of play is continued if the player stops and then resumes electronically tracked slot machine play within a single gaming establishment during the same calendar day. For each gaming establishment, a player must use the same definition of 'session of play' for all electronically tracked slot machine play during the same tax year.

Tracks Gains and Losses. To determine wagering gain or loss from electronically tracked slot machine play at the end of a session, a player must:

- Recognize a gain if the total dollar amount of payouts exceeds the total dollar amount of wagers placed during that session, or

- Recognize a loss if the total dollar amount of wagers exceeds the total dollar amount of payouts during that session.

If the IRS finalizes the proposed rules, the regulations generally would be effective for tax years ending on or after the date of publication. However, some adjustments are possible. For example, many gamblers would appreciate a more flexible definition of 'session of play,' because play often isn't interrupted by the end of a calendar day. Contact your tax professional for the latest news on reporting online gambling activities.

Report Winnings in Full

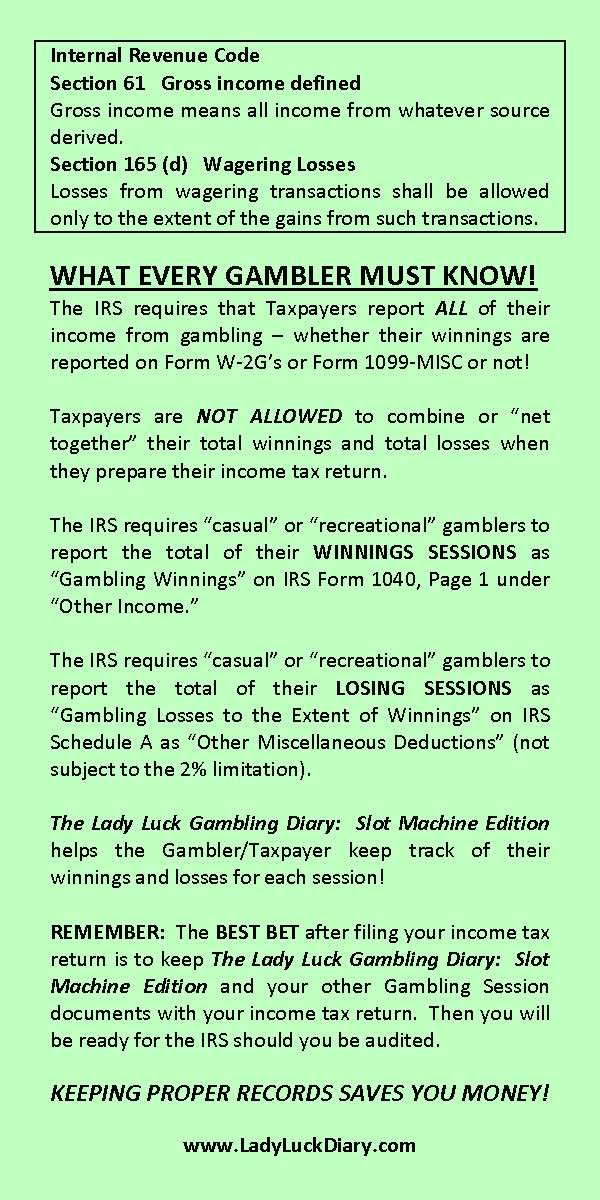

Theoretically, the full amount of an amateur gambler's winnings must be reported as gross income on the miscellaneous income line of Form 1040. Winnings include cash and prizes collected from lotteries and raffles, as well as installment payments.

For most types of gambling at legitimate gaming facilities, you'll be issued Form W-2G, 'Certain Gambling Winnings,' if you win $600 or more and the amount won is more than 300 times the amount wagered. However, a $1,200 tax-reporting threshold applies to winnings from slots and bingo, a $1,500 threshold applies to keno winnings and a $5,000 threshold applies to poker tournament winnings. When winnings exceed $5,000, federal income tax withholding is generally required, except for winnings from slots, bingo or keno.

Important Note: Because the IRS also gets a copy of Form W-2G, make sure gambling winnings reported on your return at least equal the collective amounts reported on Forms W-2G.

Limited Deduction for Wagering Losses

An amateur gambler's wagering losses can be claimed only as a miscellaneous itemized deduction. Losses for the year can't be netted against winnings for the year with only the net figure reported as gross income on page 1 of Form 1040. Amateur gamblers who don't itemize can't claim gambling loss deductions.

In addition, the itemized deduction for wagering losses is limited to the amount of gambling winnings. Any excess losses for a year can't be carried forward. For a married couple filing jointly, the wagering winnings of both spouses are combined to determine the allowable itemized deduction for combined wagering losses incurred by both spouses.

There's no requirement for losses to be from the same types of gambling activities as winnings. For example, slot machine losses can be deducted against poker winnings, subject to the losses-cannot-exceed-winnings deduction limitation.

For example, suppose you go to Las Vegas several times in 2015 to gamble. Early in the year, you win $10,000 playing poker and blackjack. Later in the year, you have a cold streak playing the slots and lose $15,000. On your 2015 federal tax return, you must report the $10,000 of winnings as miscellaneous income. You then report the $10,000 allowable wagering loss (equal to your winnings for the year) as an itemized deduction. However, the $5,000 excess loss can't be deducted in 2015 or carried forward.

No Deductions for Out-of-Pocket Expenses

Only the cost of an amateur gambler's losing wagering transactions are considered gambling losses. Out-of-pocket gambling-related expenses — such as transportation, meals and lodging — don't count as gambling losses and can't be written off. They're considered nondeductible personal expenses.

Documenting Wagering Losses

Gambling wagering losses must be adequately documented to be deductible. Under IRS Revenue Procedure 77-29, an amateur gambler must record the following information in a log or similar record:

- Date and type of specific wager or wagering activity,

- Name and location of the establishment, and

- Amount won or lost.

Also record the names of any other people present with you at the gaming establishment. Obviously, this isn't possible when gambling at a public venue, such as a casino or race track.

The guidance allows taxpayers to substantiate income and losses from wagering on table games by recording the number of the table played and keeping statements showing casino credit issued to the player. For lotteries, you can document winnings and losses with winnings statements and unredeemed tickets.

Keeping Records by Gambling Session

Until recently, the IRS claimed that an amateur gambler must report the full amount of winnings from each roll of the dice and every spin of the slot machine from casino euro on page one of Form 1040. This results in higher adjusted gross income (AGI) than just reporting net winnings from each gambling session. It also can potentially trigger undesirable AGI-based phase-out rules. For example, it could reduce college tuition tax credits or decrease tax-free Social Security benefits.

Of course, nobody actually tracks each roll of the dice and every spin of the slot machine. Thankfully, the IRS allows casual slot players to simply record the net winning or net loss from each gambling session. A session is deemed to end when the player cashes out or runs out of money. At that point, it's possible to calculate how much was won or lost during that session. If the player then reports the sum total of the net winnings from all winning sessions as gross income on page one of Form 1040 and keeps track of the sum total of the net losses from all losing sessions for purposes of claiming the itemized deduction for gambling losses, the IRS will consider that methodology close enough to recording winnings and losses from each spin of the slot machine.

In a 2009 decision, the Tax Court appeared to endorse this per-session approach to recordkeeping for casual slot players. (Shollenberger v. Commissioner, T.C. Memo 2009-306) Presumably, the concept of recording per-session net winning and loss may also be considered sufficient for other forms of amateur gambling.

Gambling on Your Taxes Can Be Costly

There's no place for gambling when it comes to preparing your federal tax return. Play it safe and contact your tax professional today about how to accurately track gambling-related winnings, losses and expenses on your 2015 federal tax return. Start tracking your winnings and losses as soon as possible. Waiting until year end to recreate the required records can be difficult and time consuming.

There are plenty of reasons why you should keep a gambling diary or gambling log, but the best reason of all is simple—the IRS would be very Online slots real money no deposit bonus australia online. unhappy if they decided to audit you and found out you didn't have one.

A gambling diary, also known as a gambling log, is simply a written account of your wins and losses when you gamble. Some amateurs decide to keep them because they've gotten it in their head that they can lose a bunch of money gambling then write off all the losses on their taxes. Pro tip: You can only write off losses equal to wins.

Pros and regular gamblers keep them because of the Big House mentioned above. If you get audited by the IRS and you have a large amount of gambling income, they're going to want to see some proof.

But what is a 'large amount' of gambling income? What does a gambling diary or log even look like? Let's dive in and take a look.

How Much You Need to Win for a Gambling Diary to Make Sense

For a gambling diary to actually make sense (which is to say, for it to be reasonable from a tax standpoint for you to start keeping one), you need to win over a certain amount each year. Below certain thresholds, you don't need to report gambling income to the IRS.

Those thresholds are pretty straightforward. The first one is $600 or 300 times whatever you wagered. If you walk away with 1,000 bucks at roulette, then you'll have to report the income.

The rules are a bit different for some other games though.

Poker tournaments, for example have a much higher threshold. You only have to report those winnings if you walk away with more than $5,000. Some fall in the middle. Real money Keno is treated differently at $1,500, and bingo and slot machines fall into the $1,200 range.

What makes things doubly confusing is exactly how you define 'winnings.'

For Example:If you sit down at a slot machine and win big on your first play, then keep playing until all that money is gone, do you have winnings in the eyes of the IRS? No.

In Your Gambling Diary, Track Wins and Losses by Session

If keeping a gambling diary meant I had to track every single play, I probably wouldn't bother (and I doubt anyone else would either). Thankfully, that's not how the IRS asks you to track your wins and losses.

Instead, the IRS wants you to track by session, where a 'session' consists of any period of continuous play without cashing out. The only real caveat here is that a session can't last more than a day.

So, what does that look like in practice? Let's say you go to The Venetian, take a seat at a real money slot machine, and start playing. You win big on your first play, but you keep going until you've spent all your winnings (and then some). You're there for an hour and a half, and when you're done with the machine, you end up down $50—that's a session.

For Example:Let's say you then head over to The Mirage to play blackjack. You bust on the first few hands, but then you start to do alright. You walk away up $100—that's a session.

So, even though you are technically only up $50, the IRS is going to want to see those sessions separated out. They want to see that you lost $50 on slots at one casino and that you won $100 at blackjack at another casino.

Why do they care about this? Because it affects your adjusted gross income. When it comes time to pay your taxes, even if you were way down for the year, those winnings are still counted as income. If you make $50,000 for the year at your full-time job, and you won $10,000 but lost $20,000, your net income was $40,000, but the IRS is going to count your adjusted gross income as higher than $50,000.

This can affect the taxes you pay each year and may reduce certain tax benefits. The important thing to walk away with is that you must report that income. If the IRS decides to throw you an audit party, and you haven't kept track of that income in a gambling log, that party isn't going to be much fun.

Here's What You Should Track in Your Gambling Log

Okay, hopefully you're convinced that you should keep a gambling diary to keep the IRS off your back, but what exactly should you be tracking in there, anyway? It's pretty clear that you should be tracking your 'sessions,' but what does that look like? Best poker handles knives.

Gambling wagering losses must be adequately documented to be deductible. Under IRS Revenue Procedure 77-29, an amateur gambler must record the following information in a log or similar record:

- Date and type of specific wager or wagering activity,

- Name and location of the establishment, and

- Amount won or lost.

Also record the names of any other people present with you at the gaming establishment. Obviously, this isn't possible when gambling at a public venue, such as a casino or race track.

The guidance allows taxpayers to substantiate income and losses from wagering on table games by recording the number of the table played and keeping statements showing casino credit issued to the player. For lotteries, you can document winnings and losses with winnings statements and unredeemed tickets.

Keeping Records by Gambling Session

Until recently, the IRS claimed that an amateur gambler must report the full amount of winnings from each roll of the dice and every spin of the slot machine from casino euro on page one of Form 1040. This results in higher adjusted gross income (AGI) than just reporting net winnings from each gambling session. It also can potentially trigger undesirable AGI-based phase-out rules. For example, it could reduce college tuition tax credits or decrease tax-free Social Security benefits.

Of course, nobody actually tracks each roll of the dice and every spin of the slot machine. Thankfully, the IRS allows casual slot players to simply record the net winning or net loss from each gambling session. A session is deemed to end when the player cashes out or runs out of money. At that point, it's possible to calculate how much was won or lost during that session. If the player then reports the sum total of the net winnings from all winning sessions as gross income on page one of Form 1040 and keeps track of the sum total of the net losses from all losing sessions for purposes of claiming the itemized deduction for gambling losses, the IRS will consider that methodology close enough to recording winnings and losses from each spin of the slot machine.

In a 2009 decision, the Tax Court appeared to endorse this per-session approach to recordkeeping for casual slot players. (Shollenberger v. Commissioner, T.C. Memo 2009-306) Presumably, the concept of recording per-session net winning and loss may also be considered sufficient for other forms of amateur gambling.

Gambling on Your Taxes Can Be Costly

There's no place for gambling when it comes to preparing your federal tax return. Play it safe and contact your tax professional today about how to accurately track gambling-related winnings, losses and expenses on your 2015 federal tax return. Start tracking your winnings and losses as soon as possible. Waiting until year end to recreate the required records can be difficult and time consuming.

There are plenty of reasons why you should keep a gambling diary or gambling log, but the best reason of all is simple—the IRS would be very Online slots real money no deposit bonus australia online. unhappy if they decided to audit you and found out you didn't have one.

A gambling diary, also known as a gambling log, is simply a written account of your wins and losses when you gamble. Some amateurs decide to keep them because they've gotten it in their head that they can lose a bunch of money gambling then write off all the losses on their taxes. Pro tip: You can only write off losses equal to wins.

Pros and regular gamblers keep them because of the Big House mentioned above. If you get audited by the IRS and you have a large amount of gambling income, they're going to want to see some proof.

But what is a 'large amount' of gambling income? What does a gambling diary or log even look like? Let's dive in and take a look.

How Much You Need to Win for a Gambling Diary to Make Sense

For a gambling diary to actually make sense (which is to say, for it to be reasonable from a tax standpoint for you to start keeping one), you need to win over a certain amount each year. Below certain thresholds, you don't need to report gambling income to the IRS.

Those thresholds are pretty straightforward. The first one is $600 or 300 times whatever you wagered. If you walk away with 1,000 bucks at roulette, then you'll have to report the income.

The rules are a bit different for some other games though.

Poker tournaments, for example have a much higher threshold. You only have to report those winnings if you walk away with more than $5,000. Some fall in the middle. Real money Keno is treated differently at $1,500, and bingo and slot machines fall into the $1,200 range.

What makes things doubly confusing is exactly how you define 'winnings.'

For Example:If you sit down at a slot machine and win big on your first play, then keep playing until all that money is gone, do you have winnings in the eyes of the IRS? No.

In Your Gambling Diary, Track Wins and Losses by Session

If keeping a gambling diary meant I had to track every single play, I probably wouldn't bother (and I doubt anyone else would either). Thankfully, that's not how the IRS asks you to track your wins and losses.

Instead, the IRS wants you to track by session, where a 'session' consists of any period of continuous play without cashing out. The only real caveat here is that a session can't last more than a day.

So, what does that look like in practice? Let's say you go to The Venetian, take a seat at a real money slot machine, and start playing. You win big on your first play, but you keep going until you've spent all your winnings (and then some). You're there for an hour and a half, and when you're done with the machine, you end up down $50—that's a session.

For Example:Let's say you then head over to The Mirage to play blackjack. You bust on the first few hands, but then you start to do alright. You walk away up $100—that's a session.

So, even though you are technically only up $50, the IRS is going to want to see those sessions separated out. They want to see that you lost $50 on slots at one casino and that you won $100 at blackjack at another casino.

Why do they care about this? Because it affects your adjusted gross income. When it comes time to pay your taxes, even if you were way down for the year, those winnings are still counted as income. If you make $50,000 for the year at your full-time job, and you won $10,000 but lost $20,000, your net income was $40,000, but the IRS is going to count your adjusted gross income as higher than $50,000.

This can affect the taxes you pay each year and may reduce certain tax benefits. The important thing to walk away with is that you must report that income. If the IRS decides to throw you an audit party, and you haven't kept track of that income in a gambling log, that party isn't going to be much fun.

Here's What You Should Track in Your Gambling Log

Okay, hopefully you're convinced that you should keep a gambling diary to keep the IRS off your back, but what exactly should you be tracking in there, anyway? It's pretty clear that you should be tracking your 'sessions,' but what does that look like? Best poker handles knives.

What the IRS Wants to See:Mostly are amounts won and what days they were won. But if you're under audit, that may not be enough. However, when it's time for you to report your own income on your taxes (and you're not under audit), you're probably fine with just the amounts and the dates (I recommend the dates just to keep things clear in your head).

Irs Gambling Sessions

Beyond that, if you want to play it safe and stay in the good graces of the IRS if they do come knocking, I would recommend that you write down dates and times at the very least, and definitely the location you were playing at.

You'll also want to be writing down addresses, maybe some specific wagers (especially wagers that won big and were enough for the establishment to issue you a W-2G). And you'll even want to consider noting the names of people you were with or employees if you have that info.

The point of all that is just to keep you triple safe and to provide the IRS the ability to talk to whomever they need to talk to and make sure you're not trying to pull a fast one.

Don't Forget Your 'Verifiable Documentation'

The IRS isn't stupid. They don't want to just see your little diary and say, 'Oh, okay, that's probably sufficient.'

They also want to see 'verifiable documentation.' Basically, they want to see proof that the $10,000 you claim to have won over the year actually ended up somewhere (and isn't a figure you made up so that you could write off your $10,000 in losses for the year).

What does that look like? It looks like banking records that show you deposited a check. It looks like canceled checks or credit records. It looks like receipts, proof that this money you made actually got spent in some fashion.

All that being said, fear of the IRS is not the only reason you need to be tracking your gambling in a gambling diary. It can also be incredibly useful to you as a gambler.

Keep a Gambling Log to See How You're Really Performing

Here's why I really love keeping a gambling log. It can give you a realistic view of how you're performing!

As human beings, we tend to struggle to have a realistic picture of what our skills actually are. That's just a universal truth about life. When it comes to gambling, I believe it can get even worse because we get out of the mindset of paying attention to the math and numbers and get caught up in the fun and amusement of it all.

This is especially true for dramatic wins and losses. A big win can make it feel like we're really doing well (or getting really good at playing poker) when the numbers might show that, overall, we perform far better playing real money blackjack (or maybe that blackjack is just more profitable for us in the long term).

Keeping a gambling log is more than just dates and times and winnings for someone who is serious about improving their skill and playing to win. I think the best gamblers out there are the guys and gals who are rigorous about tracking what they're doing and seeing where they can improve.

However, what's far more common is to see gamblers who basically have no clue what their skill level really is. When you put the screws to them, they usually can't tell you more than anecdotes. Maybe one time, a few years ago, they won this huge pot. And another time they won this and that.

And yet these are the people who always seem to walk away down, who can't quite seem to turn those few times they won into a consistent game.

Now, part of the problem with these types is almost certainly ego (or they're just caught up in the magic of their few big wins and can't see the bigger picture). But a gambling diary or gambling log could be of immense help to these guys and gals. It could help them improve their craft and really look at the facts instead of rolling the dice every time without a care.

Conclusion

Irs Gambling Sessions

A gambling diary is critical for anyone who gambles regularly. It keeps the IRS off your back and serves as additional proof that you won and lost what you claimed you won and lost.

Irs And Gambling Sessions

But more than that, it can serve as a way of tracking your true performance and improving your skills.

Irs Gambling Session Rules

Do you keep a gambling diary? Do you track anything I didn't mention in your gambling log? Tell me about it in the comments!

Please enable JavaScript to view the comments powered by Disqus.